Designing an Effective Chart of Accounts for Churches: CLA CliftonLarsonAllen

To develop an ideal structure of cost centers, review your strategic plan (if one exists), organizational chart, and previous budgets. If a formal organizational chart doesn’t exist, map one out quickly by hand. Have a brief discussion with senior and executive pastors about how they see the vision, plans, and org chart changing over the next three to five years. These categories are based on the Unified Chart of Accounts (UCOA), a nonprofit-specific, standardized sample chart of accounts. However, many churches find the UCOA too detailed and are better off using other church-specific templates that they can customize to meet their needs.

Assets

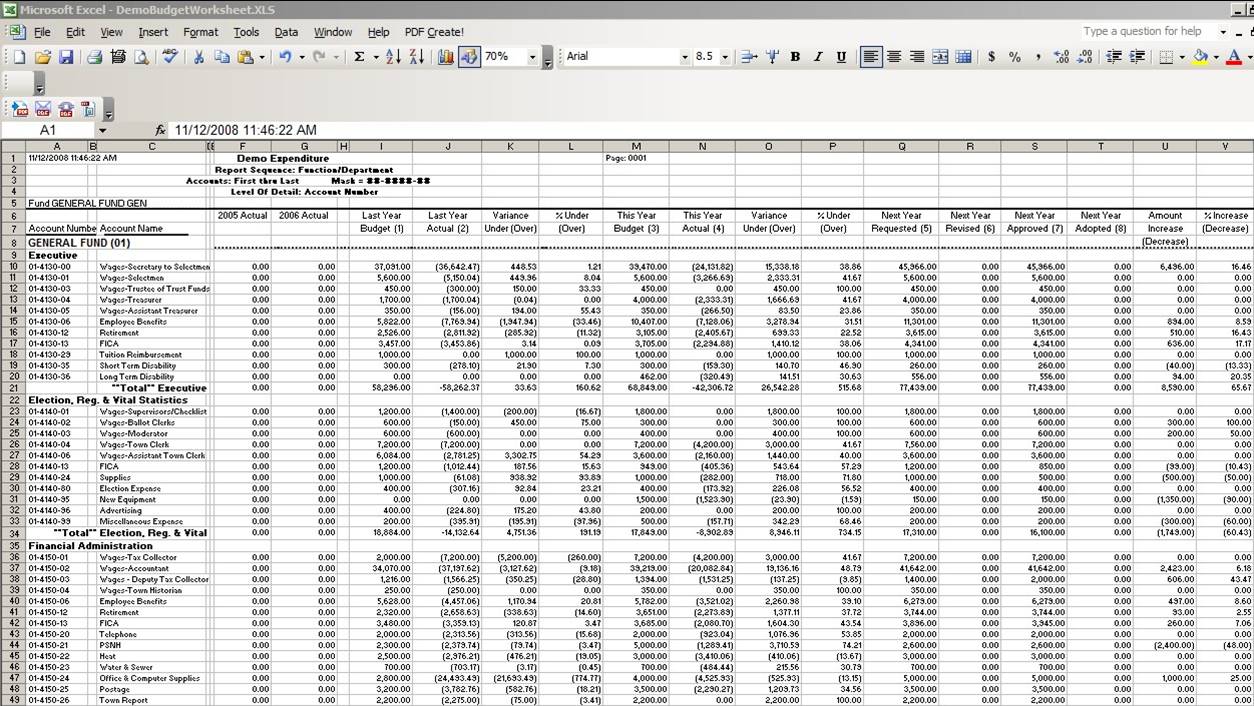

It’s important to design a COA that fits the church’s needs and to review and update it regularly to ensure it continues to serve its purpose effectively. By understanding and effectively utilizing a Chart of Accounts, churches can ensure they are managing their finances in a way that best supports their mission and serves their recording transactions community. A church’s Chart of Accounts is simply a list of accounts and categories that help to organize its financial transactions. „List“ doesn’t sound nearly as spiffy as „Chart of Accounts“ so I can understand why they named it that. As you can see there are two separate entries happening to pay a bill via the accounts payable, and numerous accounts are involved.

Step 1: Identify Your Account Categories

Each of the above examples will have its own balance and value across your entire organization. Learn about the basics of working in the financials of a business, skills required, finding work and… Joshua Gordon is a lay-pastor, author, and editor of TheLeadPastor.com. Over the last two decades, Josh has worked closely with pastors and other christian leaders, helping them to sharpen and elevate their messages. Today, Joshua pastors at New Life Fellowship, a thriving church he helped plant in Cambridge, Ontario, Canada. Hopefully this article, at the very least, helps you wake up not dreading opening up your church’s Chart of Accounts tomorrow.

Revenue Diversification

- Our nonprofit accounting guide walks through the definition of fund accounting as well as the statements and documents that you must pull from your COA.

- Bookkeeping software will help simplify your church’s financial tasks.

- It’s also a good idea to review your COA periodically to ensure it continues to meet your needs.

- When it comes to accounting, churches and businesses operate in different worlds.

- Additionally, you can look for reviews or user experiences or visit us on YouTube.

- This order is for a for-profit company but nonprofits follow a similar outline.

Create a comprehensive list of all anticipated expenses, such as staff salaries, utilities, maintenance, ministry activities, and outreach programs. Include both fixed and variable costs to ensure complete coverage. Church grants received from foundations or one-time donations from benefactors can be a significant source of revenue. Track these funds separately from regular tithes and offerings.. (For example, someone donates money towards a new roof.) Document each grant or donation’s source, purpose, and conditions, and report on the fund spending.

- In other words, accounts with no activity for a fund will not show up on that fund’s reports.

- Quite often, structures in the accounting system were set up years ago, and — based on changes to your mission, strategy, and personnel — may no longer effectively serve the organization.

- This is a major difference between nonprofit and for-profit accounting software.

- We need to take a look at the net assets because this is typically called owner’s equity in most accounting software.

- Although nearly all churches are tax-exempt organizations, that doesn’t mean your church can write off tax season!

Step 7: Input Opening Balances

First, we need to understand what a normal balance is in accounting. A normal balance is a double entry accounting term that describes how an account is increased or decreased. Debits sample church chart of accounts increase asset and expense accounts while credits increase liability and revenue accounts.

These statements are essential for providing information to church leaders, members, and donors about the church’s financial health. A well-structured COA allows the church to accurately track and report on how funds are being used, which is critical for financial transparency and accountability. It can also aid in ensuring that funds are used in accordance with donor restrictions and in alignment with the church’s mission and goals. A church chart of accounts (COA) is a resource that serves as a directory of all of the church’s financial law firm chart of accounts records. It’s the foundation for all accounting procedures, allowing churches to manage and report transactions more effectively for their congregations and communities.

Designing an Effective Chart of Accounts for Churches: CLA CliftonLarsonAllen Read More »